Beginning Your Overseas Property Journey

Buying or purchasing a property overseas can be an exciting prospect for those seeking a holiday home, Mediterranean retreat, or even a retirement nest. From my experience helping investors and homeowners for decades, the process may seem complex at first. Navigating the legal, financial, and logistical challenges requires a guide you can trust to avoid pitfalls and manage risks effectively. Using Smart Currency Exchange Your Overseas Home strategies can protect your investment and make your journey abroad smoother.

The first step is understanding the foreign laws, taxes, and market dynamics of the country where you plan to buy. Proper research, including online listings, pictures, reports, and trends, helps you analyze prices, neighborhoods, values, and demand cycles. Engage local agents, advisors, or specialised experts to answer questions over telephone or in person. This experience saves you from careless mistakes and ensures your financial and legal protection.

When investing, consider financing, requirements, and currency fluctuations. A structured approach helps plan for long-term ownership, rental income, or future resell liquidity. Weigh perks like lifestyle, accessibility, and amenities against risks, fees, and paperwork hurdles. For high-net-worth investors, Citizenship by Investment programs in places like Dominica or UK offer added benefits beyond just a home, while international diversification strengthens your portfolio.

Finally, make the venture enjoyable by combining virtual tours, viewing trips, and local insights. Lifestyle, beaches, villages, cities, and cultural experiences all shape your decision. Investigate thoroughly, engage reliable partners, and trackable cost-effective transfers for smooth closing deals. My tips from TEKCE Real Estate blog show that with careful planning, due diligence, and a Wise provider, buying property overseas can be rewarding, secure, and a unique addition to your assets and lifestyle.

Table of Contents

Choosing the Right Country for Your Overseas Property

When buying property in another country, the first step is understanding the reasons behind your goal—whether it’s a vacation home, retirement home, rental investment, obtaining a second citizenship, or a combination. Defining the purpose of your purchase lays the foundation for the entire process and helps you plan your journey abroad. Start by listing your non-negotiables, deal-breakers, and timeline, then narrow your options to the best countries that meet your needs. Talking to real estate professionals and legal advisors early makes the process more straightforward and productive.

Once your goals are clear, identify the type of home and location that suits your lifestyle. Consider factors like climate, cost of living, laws, local amenities, culture, safety, quality healthcare, and infrastructure. Research the markets you’re interested in, including average prices, market’s stability, political and economic conditions, crime statistics, and local rules for foreign ownership, residency, or citizenship requirements. For example, the Caribbean offers attractive passport perks, but strict regulations for foreigners mean you must meet all legal considerations before committing.

Finally, choose a suitable location based on your short-term and long-term plans. Study the popular areas, ensure the market aligns with your investment and lifestyle goals, and select the best country to buy. Whether you plan to rent, relocate, or retire, understanding local laws, foreign ownership rules, and citizenship requirements protects your investment and avoids costly mistakes. A well-researched, focused search makes acquiring a new home abroad straightforward, rewarding, and secure.

Choosing the Right Country and Location for Your Overseas Property

The first step in buying property abroad is choosing the right country and location that fits your holidays, holiday home, or plans to retire. Important factors to consider include prices, accessibility, healthcare, lifestyle, and residency requirements. For buyers outside the European Union, it is vital to understand immigration and visa permits, while investors must check the appeal and potential of property markets. Speak with a property expert to ensure you can legally commit to a purchase and are allowed to use the property as you wish, avoiding limitations or future restrictions.

It’s essential to research the country’s laws, tax systems, ownership rules, inheritance regulations, and foreign buyer restrictions. To avoid pitfalls, hire an independent, English-speaking lawyer who specialises in international transactions and can help you understand legal and financial requirements, tax implications, and permits. This step ensures a smooth and secure purchase while protecting your investment, lifestyle, and long-term plans for your home abroad.

How Smart Currency Exchange Supports Your Overseas Purchase

When buying property abroad, currency rates fluctuate constantly, and this can impact your buying power and overall budget. Using a currency specialist ensures you get the best rate, lock in favorable rates for future payments, and protect yourself from market volatility. From my experience, protecting your budget with Smart Currency Exchange not only makes investing in a holiday, retirement, or rental home abroad smoother but also gives confidence that your payments will remain predictable and cost-effective.

Understanding European Union (EU) Restrictions for Buyers

For buyers looking to buy property in the 27 countries of the EU, rules apart from Ireland and UK are governed by the Common Travel Area. Citizens from outside the EU are limited to staying 90 days in every 180 days and need a visa if they plan to stay beyond that. For retirees, the process is fairly straightforward, and the Easiest Place to Retire Overseas often involves options like a golden visa or investment program. For working people, it can be more complicated, but understanding these rules ensures a smooth purchase and helps plan long-term property investment in the EU.

Spain: A Top Choice for Overseas Property

Spain is a favourite destination for buyers abroad thanks to its warm climate, affordable property, and well-established expat communities. Travel is easy, with UK flights year-round to many regional airports, making relocation or holidays convenient. Post-Brexit worries have largely melted away, and retirement visas are relatively easy to obtain, attracting the British largest cohort of buyers abroad. With its combination of lifestyle, accessibility, and friendly regulations, Spain remains a reliable and rewarding choice for property investment.

France: Diverse Properties for Every Buyer

France is ideal for those seeking countryside retreats or coastal properties, offering strong legal protections for buyers. There is a wide range of property, from highly affordable cottages in Normandy and Brittany to pricey estates on the Riviera or luxury ski resorts like Courchevel. Whether looking for a quiet home or a holiday investment, France combines security, charm, and variety, making it a top choice for international buyers.

Portugal: A Welcoming Choice for Buyers Abroad

A fun fact is that Portugal and England signed a military alliance in 1373, making it one of the oldest in the world, and this firm friendship extends to British buyers today. With a warm welcome, easy visas, and tempting tax schemes, the Algarve region attracts retirees seeking sunshine and a relaxed lifestyle, while Porto, Lisbon, and Madeira remain favourites for digital nomads. Portugal’s combination of history, friendly regulations, and lifestyle makes it a top choice for property investment abroad.

Italy

Italy is famous for its rich culture and history, offering stunning landscapes from Lake Como in the north to Sicily in the south and Tuscany in between. It is a top choice for a holiday home, and buyers have many property options, which include charming farmhouses, seaside villas, modern apartments, and city homes in Rome, Milan, or Florence. With its combination of lifestyle, beauty, and variety, Italy provides opportunities for both leisure living and investment abroad.

Greece: Affordable Islands and Welcoming Lifestyle

Greece is known for its glamour and relaxed expat life, featured in shows like Mamma Mia and the Durrells. Property is highly affordable, with an enormous choice across 200+ inhabited islands and the mainland, from Athens to white sand beach towns. Taverna culture is welcoming, and beaches are rarely far away, making it a perfect destination for holiday homes or permanent living for buyers seeking beauty, lifestyle, and investment opportunities.

Cyprus: A Warm Mediterranean Home

Cyprus offers a warm, Mediterranean welcome where English is spoken by most people, making it easy for home buyers from the UK and beyond. The island has long ties to the UK, and driving on the left adds familiarity for British buyers. Its unique flavour, location within easy reach of Central Europe, the Middle East, and North Africa, and relaxed lifestyle make Cyprus a top choice for those seeking a sunny, secure, and accessible property destination.

USA: Exciting Property Opportunities

The USA is an exciting destination for British buyers thanks to its diverse lifestyles and well-known locations like New York City, California, and Florida with sunshine and theme parks year-round. Its top choice appeal comes from English–speaking Americans, big cities, and plus the fact that buying costs are often cheaper than in Europe. From vibrant urban living to relaxed coastal property, the USA offers options that suit both work and leisure, making it a practical and enjoyable place for international buyers.

Understanding Local Rules for International Property Investment

Foreign investors can buy property freely in some countries, while in others they are only allowed to own a home in specific areas, so it is important to understand how ownership rules available to foreigners may affect your rights, long-term security, and future plans. From my experience, checking the fine details in each listing and speaking with a real estate agent or consultant early can assist with acquiring not just property, but also citizenship or permanent residency through investment routes. An advisor can explain requirements to plan your stay in a country, such as the Grenada Citizenship Investment program, where a residency period is needed to keep your status, or Antigua, where non-citizens purchasing property face different taxation rules but may benefit when pursuing an approved development.

Set a realistic overseas property budget

If you’ve ever wondered why buying homes abroad can seem lower than in your own area, it’s important to bear in mind the extra costs involved. From my experience, people often look only at the sale price they see through windows or online listings, but fees add up quickly. These can include gaz, legal charges, taxes, and payments to an estate agent, all of which should be planned before committing. Working closely with a trusted estate agent helps you see the full picture early, so your overseas budget is realistic and stress-free from the start.

Building a Realistic Overseas Property Budget

When setting a budget to buy property abroad, many buyers focus only on the purchase price, but from my experience this is where mistakes begin. You must plan for additional expenses such as Property buying taxes, Legal fees, notary, Surveyor, Translation, Utility connections, insurance, registration, maintenance, renovations, and even homeowners association charge. These additional costs can add 10%-15% in places like the Mediterranean, and even more in countries with stricter controls such as the UK, Australia, New Zealand, and Canada, so affordability is often overlooked without careful planning.

A smart budget must also include a buffer for currency fluctuation, which can affect the total cost and your buying power in volatile markets. I always advise clients to monitor the exchange rate, follow news, and consider hedging strategies to reduce financial impact. If you Speak to Smart Currency Exchange, you can access the interbank rate—which is not available to most property buyers—and get as close as possible depending on the amount and timescale. You can call or email to request a currency quote, which helps protect your budget and avoid sudden losses.

Understanding financing options is equally important, as a foreign mortgage can be more complicated than domestic lending. Many foreigners face higher deposits of 30-50%, need proof of income, and find it easier to borrow in their home country. Some companies offer construction loans or payment plans designed to accommodate building properties from international developers, but you should always consult an expert to check safety, reliability, and loan terms. A financial advisor can review your assets, discuss finances, and help ensure you have enough money, whether paying the full amount in cash or using a structured loan.

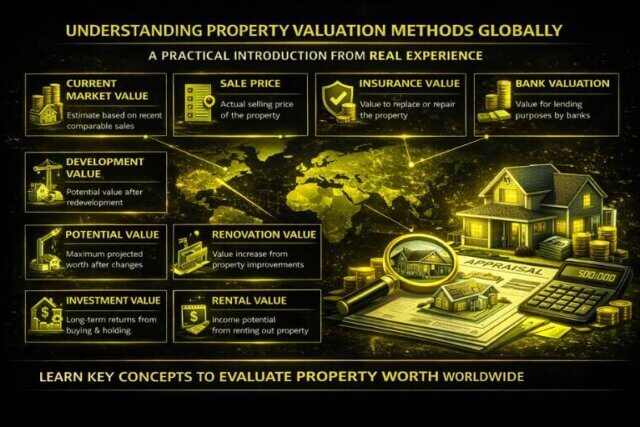

Finally, budgeting is not complete without understanding the real estate market in each country, as unique laws, regulations, and levels of buyer protection vary significantly. You must investigate thoroughly by reviewing online listings, pictures, reports, and market dynamics, then analyze long-term trends, prices—whether rising, stable, or declining—plus values, neighborhoods, restrictions, ownership, and special conditions for buyers. A local agent is invaluable for helping you navigate these complexities, assess liquidity, and determine how quickly and easily you could sell if future plans change. Planning for contingency, unexpected emergency repairs, setup, management, and keeping the house accessible year-round ensures your investment decision is realistic, resilient, and secure.

Securing the Right Financing for Your Overseas Purchase

Not every property purchase needs to be made with cash, but whether you use your own money or borrowed funds, buyers need a fair bit of planning. Start by reviewing your finances and assess all options for overseas mortgages when buying abroad. For non-residents, rules vary across countries and markets, and while some offer favorable loan terms with competitive interest rates and flexible repayment plans, many foreign lenders require significant down payments, apply higher costs, or impose strict limits on loan amounts.

From experience, working with a financial advisor who specializes in international real estate transactions helps you navigate complex eligibility criteria, tax implications, and currency exchange risks. Always compare offers, durations, and prepayment penalties, and consider funding sources such as savings, pension, a lump sum from selling existing investments, or equity release schemes. Countries like Spain, France, and Portugal have UK-based lenders familiar with overseas buyers, while an independent broker can help structure financing that supports retirement or long-term plans.

Viewing Properties and Making the Right Offer

Most buyers begin with online listings as a starting point, which helps with narrowing the selection before visiting properties in person. From my experience, seeing a property first-hand is essential before committing, as photos rarely show everything that matters, such as layout, surroundings, and condition. Taking time to visit shortlisted homes allows you to compare options confidently and make an informed offer that suits both your needs and long-term plans.

Building the Right Professional Team

When you buy property overseas, having the right professional services in place protects your home, finances, and peace of mind. From experience, the safest approach is to engage a currency broker, lawyer, and property expert early—ideally after you’ve viewed homes but before signing contracts. Always hire independent professionals who speak the language and understand local property services, immigration, and rules if you plan moving to another country. A financial adviser can explain how the stage you buy at may affect your finances, while buyers should also choose to employ a surveyor, which is common in many countries, including the UK, to ensure the purchase is secure and well-informed.

Planning Your Property Viewing Trip

Before visiting properties, start with online enquiries through a trusted portal and open a clear dialogue with your agent about your requirements, budget, and timescales. From experience, confirming potential viewings by email before your trip helps secure approval and saves time, which is often limited. Relying on faith alone is risky, so using local knowledge helps avoid unnecessary stress and ensures you go at the best time. It’s wise to skip public holidays, Sundays, and the height of summer, as many agents may be unavailable—something I always advise clients to consider when planning travel.

Viewing Independently or With an Agent

When deciding whether to view properties independent or with estate agents, consider the risk and hidden costs of planning a trip alone, including accommodation, hotel, or ferry expenses. From experience, an agent-led viewing tour often brings better deals, as the itinerary is not randomly dictated, and you gain local advice on each neighbourhood, plus access to amenities, healthcare, and transport. Agents also help with paperwork like the NIE in Spain, guide you through making a formal offer, support negotiation, and increase the chance of a successful outcome. Once a reservation deposit is paid to lock a property, always speak to a lawyer before you sign, ensuring the deposit is refundable if you change your mind and protecting your investment from the start.

How Smart Currency Exchange Supports Your Viewing Trip

Before a viewing trip, opening a no-obligation account with Smart Currency Exchange helps you plan with confidence, something I always recommend from experience. This allows you to prefund your property purchase and secure the transfer of funds smoothly when you need to pay a reservation deposit, removing stress and delays. Having this set up early means your money is ready at the right time, so you can focus on choosing the right home instead of worrying about payments.

Due Diligence and Signing Contracts

When buying a property in different parts of the world, from Spain to Portugal, Italy, or the UK, buyers must conduct thorough due diligence before signing any contract. Whether off-plan or typical completion, it’s common to pay a reservation deposit—like a contrato arras, promessa compra e venda, or contratto preliminare—which commits both buyer and seller. A trusted lawyer ensures legal home matters are checked, including outstanding debts, claims, and that the title is clear and registered in your name. Scheduling a survey is essential, especially in rural areas, and careful paperwork review avoids gazumping and protects your purchase. Typically, buyers have 15-30 days to sign once all checks are complete, giving a safe path to ownership anywhere in the world.

Completing the Purchase and Transferring Funds

On the completion day, the final payment is made and ownership is officially transferred in many countries, including France, Spain, and Italy, often at a European notary’s office. The notary or government official will check that the purchase fulfils all legal obligations, and state taxes are paid. Once completed, the property is registered in your name, ensuring your lawyer has protected your interests, and any future change of ownership is clearly documented.

Legal and Tax Essentials

When buyers purchase a home abroad, it’s crucial to navigate local laws and engage a qualified attorney to help with issues arising from language barriers or unfamiliar contracts and legal documents. A legal professional can guide the transaction process, protecting your interests and explaining foreign ownership rules, tax implications, inheritance, and whether your country has a Double Taxation Agreement (DTA) to prevent being taxed twice on income, rental, or capital gains. Because procedures, documentation, and practices vary between countries, it’s vital to verify ownership, secure necessary clearances, check the official land registry, and obtain proof of legitimacy for the sale. Always research real estate practices, have contracts carefully reviewed, and use certified translation services, as hiring a recommended attorney abroad helps avoid potential pitfalls and ensures your overall investment is secure.

Working with Trusted Local Professionals

When buying property in the Caribbean, especially in Antigua or Barbuda, working with trusted, local real estate agents and licensed, proven advisors can save time and effort. They help foreign buyers by guiding the process, sourcing properties, and imparting knowledge about legal requirements, documentation, and government-approved procedures. Whether you are looking at houses, villas, apartments, or condos, a qualified advisor can narrow options to the ideal home and ensure all details are signed and registered correctly.

Having lawyers, notary, and registrar as part of your impartial, third-party team ensures finalising the transaction, ownership, and residency or second citizenship application goes smoothly. Experienced advisory firms and consultancy companies provide assistance at every step, from initial listing review to travel, contact with seller, and completing the entire investment process, making it faster and more secure for both first-time investors and seasoned buyers in the Caribbean.

Visiting the Property

While photos and videos can be helpful, they are sometimes misleading, so it’s important to visit the property in person before making a purchase. Seeing the local area, condition, access to amenities, noise levels, and checking for structural issues allows costly problems to be identified early and factored into your overall budget. Virtual tours are an attractive, time–saving option, but trusted professionals recommend buyers attend and inspect in person whenever possible to ensure full confidence in the property.

Finalising the Purchase

Once the price is agreed and a deposit is made, often non-refundable to secure the order, the process of proceeding with the contract begins. The preliminary agreement or reservation option confirms your intent to buy the property and removes it from the open market. Contracts must be carefully reviewed by a legal representative, and payment schedules, additional fees, closing costs, notary legal fees, taxes, and transfer percentage must be calculated. Once complete, the property is registered in your name, a process that varies between countries and currency requirements. Staying updated with news, insight, and Expert Analysis, including daily Market Commentary, helps you make informed decisions and avoid surprises in the world of international property.

Final Conclusion

Buying property internationally can be an exciting prospect, whether for a holiday home, retirement, investment, or second citizenship. Following a step-by-step approach—deciding on a destination, setting a realistic budget, securing financing, viewing properties, assembling a team of trusted professionals, and carefully finalising the purchase—helps foreign buyers navigate the complex legal, financial, and logistical challenges. Engaging local experts, using Smart Currency Exchange, and conducting thorough due diligence ensures your investment is protected, smooth, and rewarding, allowing you to confidently own your dream home abroad. With careful planning, research, and guidance, international property buying can transform from a daunting task into an enjoyable, life-enhancing journey.

Leave a Reply