From my years in real estate investing, I have learned a simple truth: the world constantly evolves, and so does the real estate market. In emerging markets, fast urbanization, rapid economic development, and a clear demographic trend create strong growth potential. A youthful population, a burgeoning middle class, and steady job opportunities are driving housing demand in expanding cities. These factors improve the overall appeal and allure for investors seeking opportunities beyond established markets, where slower growth often limits return on investment. With smart timing, the right location, and a clear strategy, this space becomes fertile ground for building wealth and achieving steady income.

In my own approach, I have seen how government initiatives that enhance infrastructure help attracting foreign investments and raise the higher quality of life for people. This demographic shift supports the housing market and opens many avenues to participate in investment without always buying houses outright. Options like REIT, real estate investment trust, REIG, or a real estate investment group allow pooling funds, pools of cash, and crowdfunding so real estate investors can diversify their portfolios with lower initial costs. Compared to being a landlord handling day-to-day activities and heavy hands-on work, these more passive methods reduce cons, avoid higher fees, and still tap into high returns as the garden of growth begins planting a seed that can bloom with the right care.

I have also worked with a house flipper mindset before, so I assume risk is part of investing, but the promise here is clear. Whether joining a recognized paths like REIT structures or choosing to invest directly, these recognized paths let you capitalize on growth, success, and long-term benefits. The key is to invest wisely, understand cons, and balance passive income with active choices, so investors can tap into a market that feels like a fertile ground ready to reward those who participate with patience and vision.

Table of Contents

A Practical Overview to Get Started

In my work with real estate investments, I learned that success starts with an overview of where growth is actually happening. Instead of chasing hotspots, smart investors focus on identifying growth in emerging markets, where real estate activity is gaining speed. Many locations show property values climbing due to population shifts, strong demand, and clear economic momentum. This is not gambling, but reading signals, watching numbers, and aligning with current economic trends such as post-pandemic recovery, rapid population growth, and increased urbanization across the developing world.

An important year like 2025 makes this even more promising. In the next article seven, analysts noted how emerging market equities in the MSCI index rose over 20% in the first nine months of 2025, compared to 2024, marking the strongest year-to-date performance in more than 15 years. This outperforms advanced economies, which saw only a 13% gain on an equivalent benchmark. These results came from solid economic fundamentals, benign inflation, improving financial conditions, and a weaker US dollar, all factors that tend to endure.

To invest wisely, it helps to know the standard definition of an emerging market. These include low-income countries and middle-income countries with characteristics of transitional economic growth. While investors target these areas for high returns potential, they must accept elevated risk and volatility with any investment in emerging economies. Still, real estate here remains low relative to other asset classes and geographies, often priced at one-tenth of the world’s prime assets.

From a professionally-managed real estate market view, MSCI data shows 25-30% of global equity, fixed income at 40%, and global GDP near $75bn invested annually. This is comparable to markets like the UK and Germany, though the majority of activity remains in China, the second largest real estate market globally by value. Over 15-20 years, rapid growth, integration, and the Chinese economy have absorbed capital, sometimes crowding out other geographies during major events, change cycles, and economic regimes like the Covid-19 pandemic.

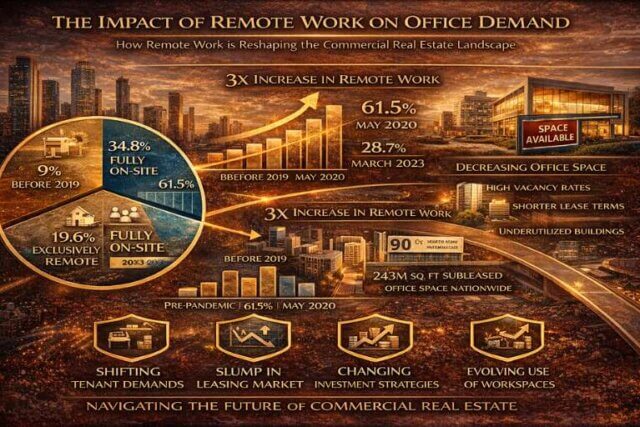

I have personally seen institutional real estate allocations to emerging economies fell, then recover based on recent data, showing a small uptick in emerging real estate markets. These shifts create exciting opportunities as companies expand operations and diversify investment portfolios. The property market is moving faster due to demographics, remote work, and digital transformation, opening new ways for investment opportunities beyond traditional residential and commercial assets.

Today, smart housing, co-living communities, and sustainable developments are shaping cities grow as technology redefines how people live. Modern real estate investment strategies are evolving to capture long term value by staying resilient, sustainable, and adaptable, whether through a city apartment, suburban warehouse, or mixed use complex. Innovation is now a main driver of property market growth, helping investors build wealth, understand trends, make smart decisions, and future proof their portfolio.

I often rely on Emerging Trends in Real Estate®, a highly regarded and widely read forecast publication, now in its 47th edition. Emerging Trends in Real Estate® 2026 by PwC and the Urban Land Institute (ULI) provides outlook on real estate investment, development trends, real estate finance, capital markets, property sectors, and metropolitan areas across the United States and Canada. It reflects views from individuals interviewed through a deep research process, where views expressed in quotation marks are opinions of industry experts, fund managers, developers, property companies, lenders, brokers, advisers, consultants, and researchers.

The report includes survey responses from over 500 individuals and almost 1,250 individuals, covering company affiliations across the real estate industry, reinforcing why emerging markets remain ideal opportunities for those who analyze opportunities, respect challenges, and make an appropriate decision to dispose resources wisely for maximum returns and good returns over time.

Reading the Signals to Find the Right Places

In my own investment work, identifying the right emerging market is crucial, and it always starts with scanning regions for steady yield and reliable returns. That means understanding local dynamics and the essential factors to consider when scouting promising markets. I first check economic indicators and look for regions with strong GDP growth, increasing employment rates, rising disposable incomes, and clear indicators that signal a healthy economy. This directly supports real estate growth, especially where population growth and a growing population drive increased demand for housing.

Next, I analyze migration trends, birth rates, and urbanization patterns to gauge potential growth, then investigate government policies and local government policies that promote real estate development through tax incentives for investors and major infrastructure projects that enhance connectivity. To stay sharp, I track market trends, stay informed on local real estate trends, and review average property prices, rental yields, and vacancy rates—these metrics provide real insight into the health of the market. Finally, I never ignore cultural factors and unique cultural dynamics that influence investment success; understanding local customs, preferences, and behaviors is crucial for making informed decisions, just as important as steps 1, 2, 3, 4, and 5 in any serious market review.

Types of Real Estate Investments in Emerging Markets

Once I have identified a promising market, the next step is determining which type of real estate investment truly aligns with my goals. Emerging markets offer various opportunities, each with a different risk profile and potential returns. Among the common types of investments, residential properties remain popular. Investing in single-family homes, apartments, or multi-family units can provide steady rental income, especially as rising demand for housing pushes yield and creates significant returns in dense urban areas. From experience, these options feel familiar and practical, making them an easy starting point for many investors following steps 1, 2, and 3.

Beyond homes, commercial real estate such as office buildings, retail spaces, and warehouses can deliver higher returns, but they also carry significant risks, so understanding the local business climate and demand for commercial space is crucial. Another sector is vacant land, where purchasing land becomes a speculative investment; as an area develops, its value can increase substantially, but this requires patience and a long-term vision. For those who prefer a hands-off approach, real estate investment trusts (REITs) allow investing while staying focused on emerging markets, provide exposure, and remove the need to manage properties directly. I have also seen vacation rentals rise with tourism, becoming lucrative in regions with beautiful landscapes and rich culture that attract tourists and create high rental demand, rounding out choices 4 and 5.

Balancing Rewards with Real Risks

From my experience, investing in emerging markets can be rewarding, but it is essential to recognize the challenges and risks involved. These markets are often volatile and unpredictable, so understanding these risks is vital for safeguarding any investment. Some common challenges include political instability, as these regions can be susceptible to political changes that affect property rights, regulations, and overall market stability. I learned early on that staying informed about local politics is crucial, just as tracking economic volatility, where rapid economic changes and fluctuations in property values and rental yields can test even seasoned investors. Being prepared for economic downturns is key to long-term success, and I often treat this as step 1 and 2 before committing capital.

Another layer of risk comes from legal complexities. Navigating local laws and regulations can feel daunting, especially within an unfamiliar legal framework, which is why engaging local experts such as real estate attorneys can help mitigate risk. I have also seen cultural barriers slow deals; understanding local culture and customs is vital for successful investments, as misunderstandings often lead to poor investment decisions and difficulties managing properties. Finally, market saturation is real—when investors flock to certain areas, markets can become oversaturated, causing decreased returns. This is why conducting thorough research and staying ahead of trends remains steps 3, 4, and 5 in my personal risk checklist.

Building a Strong Network

In the realm of real estate investing, I have seen how a robust network can make the difference between average results and strong performance, because building relationships with local real estate agents, property managers, contractors, and other investors brings invaluable insights and real support. Active networking helps you tap into local knowledge, share experiences, and identify opportunities that are not widely advertised. I always consider attending local real estate investment groups, conferences, and networking events, where engaging with investors unlocks a wealth of information, helps foster potential partnerships, and ultimately enhance my investment strategy.

Rental Income with a Modern Twist

Owning rental properties is a good choice for individuals who have do-it-yourself (DIY) skills, the patience to manage tenants, and the time to do the job properly. From my experience, this side of property ownership often starts by bringing steady cash flow, especially when assets are leveraged to acquire more property gradually. As an investor, you can acquire a growing number of income streams across multiple properties, helping in offsetting unexpected costs or losses. Over new income years, some fluctuation is normal, but scale helps smooth returns.

Although financing can be obtained with a relatively low down payment, it does require substantial cash on hand to cover upfront maintenance and to periods when the property is empty or tenants do not pay their rent. I learned this early while watching the hospitality sector entering a new phase of expansion, creating fresh investment opportunities. Short-term rentals, boutique hotels, and global travel rebounds are pushing investors toward targeting hybrid accommodation models that blend hospitality with local living experiences in fast-growing regions.

In real estate investment, serviced apartments, branded vacation homes, and flexible-use properties now offer flexibility and high returns. This revival is fueled by technology, including AI-driven pricing tools and booking platforms, helping owners optimize occupancy and revenue. As tourists seek eco-friendly, culturally immersive stays, they are pushing developers to integrate sustainability and authenticity into design and operations.

As tourism infrastructure modernizes, the short-term rental sector contributes significantly to property market growth, while balancing personal use and rental income. For investors, blending hospitality assets into portfolios in 2025 represents both lifestyle enhancement and financial diversification.

Rental Property Pros & Cons

| Pros | Cons |

| Provides regular income Offers potential appreciation Provides regular income Offers potential appreciation Can be maximized through smart leverage Many expenses are tax-deductible Rents can be raised to keep up with inflation | Managing tenants can be tedious Unexpected costs may eat up income Unpredictable vacancies can reduce income In some markets, properties are illiquid It can be difficult to sell properties quickly when conditions change n be maximized through smart leverage Many expenses are tax-deductible Rents can be raised to keep up with inflation |

House Flipping

Fast-Paced Property Turnarounds

In my journey with house flipping, I have seen that people need significant experience in real estate, especially in valuation, marketing, and renovation, because this path sits on the proverbial wild side of real estate investing. It feels closer to day trading than buy-and-hold investing, and real estate flippers are very distinct from buy-and-rent landlords. The main aim is to profitably sell undervalued properties that you buy and exit in less than six months. Most familiar flippers follow a simple flow: find a home, renovate, then sell for a profit, instead of waiting on a longer-term investment strategy.

That said, investors who take on one or two properties at a time must be careful. Property flippers invest by improving properties, but success depends on the ability to pick properties with true intrinsic value and turn them for profit with the right alterations. When someone is unable to swiftly unload a property, they can find trouble—typically, flippers don’t keep enough uncommitted cash hand to pay the mortgage for the long term, which can lead to snowballing losses if the market shifts.

House Flipping Pros & Cons

| Pros | Cons |

| Ties up capital for a short time period Offer significant returns | Requires deep market knowledge Success depends on hot markets; if cool, profits can drop unexpectedly |

Top 7 Real Estate Investment Opportunities in Emerging Markets Right now

Raleigh-Durham, North Carolina – Steady Growth in the Research Triangle

Raleigh-Durham remains one of the safest bets for real estate investors focused on long-term performance. The region is expanding with tech companies drawing talent, keeping rental demand strong while home prices are climbing. Compared to overvalued coastal metros, the area’s mix of universities, healthcare institutions, and corporate campuses creates stability and makes multifamily developments moving quickly a smart option.

Investors can find opportunities in stabilized properties, value-add properties, or land to develop and build, helping diversify a portfolio in tech-driven cities. Raleigh-Durham has become a cornerstone for a strategy that balances rent growth, long-term value, and holding potential, making it an attractive market for those looking to invest wisely.

Ann Arbor, Michigan – Where Innovation Drives Value

Investors looking to invest in a city with a strong base of startups, research labs, and the University of Michigan will find Ann Arbor compelling, as innovation is betting on higher rent levels and stable occupancy. The local economy supports tech professionals and grad students, fueling demand for rentals, owner-occupied properties, and mixed-use developments. Gaining traction, these projects offer a mix of retail, office, and residential spaces that attract modern tenants, while sustainability initiatives influence real estate values. A savvy investor can benefit by aligning assets with local development trends, targeting young professionals and higher education communities, and working with the market to stay ahead.

Knoxville, Tennessee – Quietly Becoming a Hotspot

Knoxville, Tennessee doesn’t belong only to Nashville anymore; Knoxville is earning its place on the map for serious real estate investors. The city is experiencing economic expansion with employment growing nearly 2% in 2024. Unlike Nashville, it offers attractive price points for single-family and multifamily investments, with the average price per unit over $270,000, while demand is holding strong. Investors in Knoxville are entering an early growth cycle, able to build new construction rentals or focus on buy-and-hold strategies in older housing stock, balancing affordability with an upward trend—making it a smart play for growth without the saturated competition seen in larger markets.

Central East Texas – A High-Upside Location

Central East Texas sits between two powerhouses, Austin and Dallas, and is becoming an investor’s playground as Texas’s growth story benefits from spillover population growth and logistics development. With affordability in buying suburbs, this region is poised to turn into the next city hub, as employment grew faster than the national average in 2024. Property values responded, with the average price per unit rose more than 55%, around $132,000, offering a low barrier to entry that leaves room for appreciation. For investors looking to acquire land, build new product, or reposition older properties, this high-upside location in part of Texas is clearly worth attention, even for those who don’t need to compete directly with bigger cities.

Madison, Wisconsin – Steady Is Strategic

Sometimes, the smartest move in real estate is to go with a city that keeps getting things right, and Madison is one of those places. It doesn’t explode with hype but keeps drawing educated renters, startup companies, and steady wage earners, thanks to anchors like the University of Wisconsin and a strong healthcare sector anchoring the economy. This creates reliable demand and a strong occupancy rate year after year, even when job growth dipped slightly in 2024.

Construction activity hasn’t slowed, with over 3,500 new units delivered and more than 5,000 underway, while prices per unit have climbed about $154,000, offering a reasonable entry point compared to coastal cities. The predictability, positive cash flow, and consistent tenant demand keep Madison on the radar for investors seeking steady growth without extreme volatility.

White Plains, New York – Suburban Strength Near NYC

The metro spillover effects from New York City make White Plains a place that offer excellent access to the New York City economy without the logistical headache or upfront costs of investing directly in Manhattan or Brooklyn. Seeing strong demand from renters and buyers looking for more space, many are leaving the tri-state area, while in 2024, the occupancy rate hovered around 97%, an exceptionally high figure for suburban markets.

With nearly 6,900 units under construction, prices are nearing $390,000 per unit, which signal the undeniable confidence of investors who are bullish and looking for reliable returns. Stabilized assets and opportunities to reposition older inventory in the rising rent market mean White Plains offers plenty of options for those seeking both income and long-term growth.

Tucson, Arizona – Growth That’s Hard to Ignore

Tucson, the first city that comes to mind for fast-paced development, is experiencing strong population growth, creating high demand for rentals and driving pricing momentum. It is one of the best places to position yourself right now, benefitting from key economic drivers like the University of Arizona and the booming aerospace industry, both drawing in renters and first-time buyers who are priced out of Phoenix. By 2024, developers delivered 2,300 multifamily units, with 2,400 more on the way, while institutional investors are moving in as price per unit rose 131%, surpassing $307,000—an explosive figure that signals growth and long-term confidence in the market. Tucson allows investors to ride a solid appreciation curve, locking in strong rent yields, and gives both immediate cash flow and long-term gains.

Institutional Support Enhances Investor Confidence

That leads us to the second major driver of real estate: quality of institutions. Institutions, broadly defined, include rules, regulations, formal, informal, structure, and social interactions that shape economic incentives and provide a framework for behaviour. They are represented by indicators like property rights protection, rule of law, data benchmarking, quality governance, and regulatory environment. A well-established link exists between quality institutions and economic development, which is critical given the immobile, long-term nature of real estate investments.

It stands to reason that institutional quality is important for supporting investor confidence, reducing risk, and creating a stable, transparent, predictable environment in which to deploy capital. Research models find the strongest relationship with property rights protection, though many institutional quality indicators are highly correlated. For example, robust property rights protections are generally accompanied by a strong rule of law, ensuring confidence for investors navigating emerging markets.

This range of institutional factors is important because it shapes the environment where real estate investments can thrive. Stable, transparent, and predictable governance allows investors to assess risks more accurately and plan for long-term returns, making institutional quality a cornerstone of successful real estate strategies in emerging markets.

Conclusion: Looking Ahead in Emerging Real Estate

From years of hands-on investing in real estate, I’ve seen how emerging markets truly presents unique opportunities for growth and diversification, even though challenges exist; the potential rewards outweigh risks when a well-informed, strategic approach is used, grounded in understanding market dynamics, identifying promising investment types, and building strong local network, so investors position success within dynamic environments and confidently explore world real estate investment emerging markets despite the questions process often brings, knowing they can reach out team experts guide every step investment journey.

What I’ve learned is that smart money paying attention growth outside spotlight tends to chase overheated metros less and instead focuses on targeting getting into emerging markets early to capture appreciation, steady returns, and better deals mature cities, because the key act others watching invest ahead curve mindset helps investors follow trends create trends, especially as 2025 real estate landscape dynamic diverse digital, shaped by green architecture, tokenized ownership, and best investment opportunities combine innovation long-term sustainability.

Today, smart investors recognize real estate investment evolving technology culture global economics, where property market growth shaped flexibility inclusion resilience, and focusing smart cities co-living models affordable housing becomes key balancing profitability purpose, allowing investors embrace future-oriented mindset secure financial success contribute shaping livable sustainable communities generations rather than short-term wins alone.

For transparency, views interviewees survey respondents presented direct quotations participants name-specific attribution particular individual list interview participants year’s study identified end of report, and all interviewees option remain anonymous participation quotations contained interviewees not listed back of report, so readers cautioned not attempt attribute specific individual company contributed PwC ULI extend sincere thanks sharing valuable time expertise involvement many individuals report not possible; still, emerging real estate markets offer exciting high-growth expansion opportunities companies conducting detailed analysis various markets understanding current trends companies identify most promising destinations make informed investment decisions, and with Orience’s support companies successfully navigate emerging markets maximize growth potential.

What are emerging markets in real estate?

Emerging markets in real estate are regions or cities that are seeing fast economic growth, rising population, and increasing property demand but are not yet fully developed. These markets often offer lower entry prices, higher growth potential, and improving infrastructure compared to mature markets.

What are the 4 types of real estate investments?

The four main types of real estate investments are residential properties (homes and apartments), commercial properties (offices and retail spaces), industrial properties (warehouses and logistics centers), and land (undeveloped or agricultural land).

What are the opportunities in emerging markets?

Emerging markets offer opportunities such as higher rental yields, strong appreciation potential, portfolio diversification, early entry advantages, and access to fast-growing urban areas driven by infrastructure development and population growth.

What is the 2% rule for property?

The 2% rule suggests that a rental property should generate monthly rent equal to at least 2% of its purchase price. While hard to achieve in many markets today, it is often used as a quick screening tool to assess cash flow potential.

What are the 4 P’s of real estate?

The 4 P’s of real estate are Product (the property type), Price (purchase and rental pricing), Place (location and market), and Potential (growth, income, and value appreciation).

What are the 5 emerging markets?

Five commonly cited emerging real estate markets include India, Vietnam, Brazil, Nigeria, and Mexico, due to their population growth, urbanization, and expanding economies.

What is the 7% rule in investing?

The 7% rule refers to targeting an average annual return of around 7% after inflation, which is often considered a benchmark for long-term real estate and portfolio growth.

What are the top three trends in the real estate industry?

The top three trends are digital transformation (proptech and AI tools), sustainability and green buildings, and changing living patterns such as co-living, remote work-friendly homes, and mixed-use developments.

Leave a Reply