This guide to property management is written for foreign investors and overseas investors who want the basics to navigate the U.S. market with clarity and confidence, even when investing overseas across international markets. As an overseas landlord, I’ve handled managing property abroad and managing remotely from thousands of miles, and I learned early that ownership in U.S. real estate is a serious investment that requires a careful approach, not luck or bravado. The complexity of rental properties, combined with unique challenges like cultural differences and language barriers, makes deep local research and strong decision-making essential for anyone building an expanding portfolio in today’s interconnected world.

When I moved away from my home in the Newport News area and decided to rent out the property, I faced major issues due to a previous property manager. That experience showed me how simple mistakes, ignored local laws, missing detailed inspections, and rising cost can hurt long-term success. Everything changed when I worked with Red Sail, whose professional service, easy process, constant contact, and clear communication gave me real peace of mind. Their suggested solutions addressed real problems, making them my first call and honest recommendation to other investors, including clients from Dubai exploring real estate opportunities for a holiday home or a dedicated investment property.

To manage rental properties effectively, no matter your experience level, you must focus on legal compliance, tax compliance, proper insurance, including renters insurance, timely maintenance, and clear tenant communication within the right property management model. These key considerations and best practices helped me protect my property investment and unlock a lucrative opportunity with steady annual growth rates near 8%. For anyone serious about managing property, these practical tips offer valuable insights that turn challenges into confidence-driven results.

Table of Contents

What Makes the U.S. Real estate a Trusted Choice

For foreign investors, overseas investors, global investors, and international buyers, the United States—often called the US—stands out as a top investment destination because the real estate market benefits from economic stability and a stable economy that builds real market confidence. From my own investing journey, the biggest reasons behind this strong investment appeal are transparency, a transparent legal system, and a clear legal framework supported by firm property laws and solid investor protection, which together offer rare regulatory clarity. Add to that strong rental demand driven by consistent housing demand in the rental market, attractive income potential, and reliable long-term returns, and it’s easy to see why US property continues to attract serious capital worldwide.

Economic Stability That Drives Growth

For foreign investors, international buyers, and global buyers, the United States remains one of the world’s largest economies, backed by a resilient economy that shows steady growth, low inflation, and a strong labor market, creating real macroeconomic stability. From my experience tracking market trends while managing assets, U.S. real estate stands out as a compelling option because it delivers consistent returns, protects long-term value, and opens clear investment opportunities in high-growth metro areas such as Austin, Miami, and Charlotte, where population growth and business development signal strong potential. These appreciating markets balance performance with relatively low risk, making them attractive for investors who value stability as much as growth.

Transparent legal system

For foreign investors, the United States and the U.S. offer a clear legal framework and an enforceable legal framework that make property ownership far less stressful than many other markets I’ve worked in. Strong federal laws and state laws protect investor rights through a well-structured process covering property transfers, title registration, and lease enforcement, which creates real transparency and legal certainty. In my own experience, this level of contract enforcement—where contracts and honored agreements are taken seriously—greatly reduced uncertainty, strengthened investor confidence, and ensured true asset security, helping investors secure assets with confidence in long-term stability.

Flexible Choices for Smarter Portfolios

For investors exploring the U.S. real estate market, the range of investment types supports different goals and budgets, allowing a truly tailored strategy. From my experience building a property portfolio, options like single-family homes in suburbs suit those seeking stable long-term tenants, while multi-family buildings in urban centers help scale income generation. Others focus on vacation rentals for short-term rental income, or commercial properties paired with value-add renovations and capital improvement to sharpen income objectives, making the right rental strategy a practical choice rather than a gamble.

Demand That Keeps Cash Flow Moving

For investors, Rental demand in the United States remains high due to a growing population, rising home prices, and changing lifestyle preferences that continue to reshape housing demand. In my experience managing rentals, strong demand in key states like Texas, Florida, and Georgia keeps vacancy rates low, supporting low vacancy and reliable rental income that delivers steady income. The shift toward remote work and broader remote work adoption has expanded demand beyond traditional city centers and urban markets, driving market expansion into suburban markets and non-urban markets, where I’ve personally seen new opportunities emerge as renters prioritize space and flexibility.

Financing That Supports Smart Growth

For foreign investors and international investors, the financial environment in the U.S. offers real advantages through U.S. lenders that provide flexible mortgage products and tailored financing for foreign nationals, even those with no U.S. credit history. From my experience structuring deals, access to loans with competitive interest rates and reasonable down payment requirements improves access to financing, allowing investors to leverage capital through smart capital leverage to scale portfolios and support portfolio growth efficiently. This approach helps preserve liquidity with strong liquidity management, freeing funds for other investments while maintaining security, investment security, and a clear investment opportunity that turns financing into long-term opportunity rather than risk.

First Steps for Confident Investing

If you are new to U.S. real estate, the right foundational steps and proper preparation can prepare you for a smoother investment process. From my experience guiding foreign investors and beginners in real estate investing, focusing on market entry and building investment readiness early ensures that your U.S. real estate journey avoids unnecessary mistakes, making the investment process more predictable and setting you up for long-term success.

Defining What You Want to Achieve

Before buying, it’s important to clarify goals and set clear property objectives that match your investment objectives. From my experience guiding overseas investors, deciding whether you want steady income, long-term appreciation, or short-term rental returns influences the property choice, management approach, and level of involvement you’ll need. A well-planned investment strategy and rental strategy can balance income generation with capital growth, ensuring your U.S. real estate investments meet both your financial goals and personal priorities.

Choosing the Right real estate markets

When researching U.S. real estate markets, focus on cities and areas with population growth, job creation, and strong housing demand, as these factors drive stronger rental yields and better long-term value. From my experience, careful market selection through regional analysis ensures your investments align with your financial goals and support investment alignment, helping you target properties that deliver both rental yields and long-term value for a successful portfolio.

Choose an ownership structure

When deciding on buying options, it’s important to choose the right ownership structure to match your investment structure and legal considerations. Options include an individual purchase or forming a legal entity such as an LLC, which can help with liability, taxes, tax planning, and estate planning. From my experience working with a real estate attorney, selecting the correct legal structure early makes managing U.S. real estate smoother and ensures your investments are protected and aligned with long-term goals.

Simplifying Your U.S. Finances

For overseas investors, opening a U.S. bank account is essential for financial management of property finances, including rent collection, expense management, and tax payments. From my experience, using banking options that allow remote account setup and offer a reliable local contact makes account management and payment processing seamless. Choosing the right bank services ensures you can handle your property finances efficiently, even from abroad, and keeps your investment operations organized and smooth.

Legal and tax compliance for foreign investors

Navigating Legal and Tax Rules

For foreign buyers and foreign investors, understanding FIRPTA and federal tax obligations is essential when investing in U.S. real estate, because noncompliance can lead to penalties, lost income, and transaction delays. The Foreign Investment in Real Property Tax Act (FIRPTA) requires a nonresident seller to face 15% withholding on the property sale price unless properly planned, and capital gains tax and IRS reporting rules must be carefully followed. From my experience, advance planning and professional guidance from tax advisors, legal advisors, and real estate experts help foreign investors manage sale proceeds, lease terms, and eviction timelines while meeting federal rules and reporting requirements.

In addition, state-specific rules and property taxes vary widely, so regulatory variation and legal variation demand localized knowledge. Foreign investment tax states often have state laws, tenancy laws, and eviction laws that must be followed to ensure compliance, avoid delays, and reduce the risk of penalties or reduced sale proceeds. I’ve found that working with experienced advisors familiar with cross-border real estate ensures proper planning, tax compliance, and legal compliance, even for minimal property activity, annual tax documents, and tax filings.

Finally, a structured planning strategy that incorporates federal regulations, state regulations, investment reporting, and filing obligations helps foreign investors maintain full regulatory adherence. Using investment advisors, professional guidance, and advisory services helps avoid costly surprises in sales, refinancing, or ongoing property management. By combining legal compliance, tax compliance, and investment compliance, overseas investors can confidently navigate the complex cross-border real estate landscape while maximizing returns.

Picking the Best Management Approach

For foreign investors managing rental properties, understanding property management models is key because there are multiple options depending on your budget, time availability, and personal comfort with local operations. From my experience, choosing the right model—whether full operational management by a professional or a hands-on management approach—should align with your investment strategy, desired level of property oversight, and overall goals for rental property management. Careful decision-making ensures your properties are well-managed even from afar, while matching your resources and expectations effectively.

Full-service management

For foreign investors seeking a hands-off option, hiring a local property manager for full-service property management ensures leasing, maintenance, resident communication, and legal compliance are handled with minimal involvement from the owner. From my experience, this approach provides consistent oversight, improves operational efficiency, strengthens risk management, and streamlines tenant management and compliance management, giving reliable property oversight. While it comes with a higher cost, the benefits of professional management often outweigh the effort for those managing properties from afar.

Customizable Management for Active Investors

For foreign investors considering outsourced property management, the à la carte model allows you to delegate specific tasks like rent collection, repairs, or tenant screening while keeping self-management of other responsibilities. From my experience, this approach offers flexibility and better cost control, while giving a deeper understanding of the local rental process and building operational knowledge. Effective task delegation ensures proper property oversight and smooth rental management without fully giving up control over your investments.

Managing Remotely with Smart Tools

For foreign investors opting for self-management with remote tools, digital platforms and automation make remote management of property management more cost-effective while keeping full control. From my experience, features like tenant communication, maintenance tracking, workflow automation, and vendor management allow timely issue resolution even across time zones by coordinating with trusted local vendors. This approach improves operational efficiency, simplifies handling issues, and ensures your properties run smoothly without a physical presence.

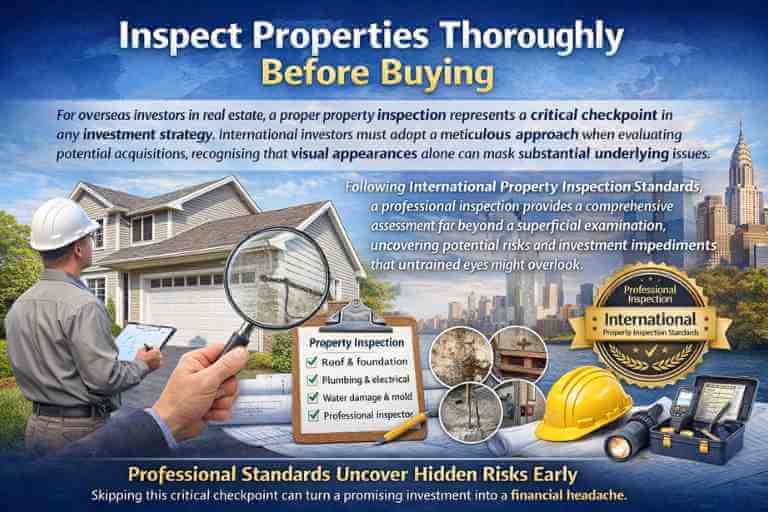

Inspect Properties Thoroughly Before Buying

For overseas investors in real estate, a proper property inspection represents a critical checkpoint in any investment strategy. International investors must adopt a meticulous approach when evaluating potential acquisitions, recognising that visual appearances alone can mask substantial underlying issues. Following International Property Inspection Standards, a professional inspection provides a comprehensive assessment that goes far beyond a superficial examination, uncovering potential risks and investment impediments that untrained eyes might overlook.

From my experience guiding overseas investment real estate investors, a detailed property evaluation is one of the most important strategies for safe acquisitions. Applying a meticulous approach and using professional inspection standards ensures all risks are identified early, helping investors avoid costly mistakes and make confident decisions. Even properties that look perfect on first glance may hide serious issues, so skipping this critical checkpoint can compromise both short-term returns and long-term success.

Key Elements to Inspect

For overseas investors managing remote property investments, a property evaluation should focus on structural integrity through a detailed integrity assessment, including foundation condition and roof condition in line with regional construction standards. Critical areas also include electrical system system evaluation, plumbing infrastructure and infrastructure analysis, as well as moisture detection to identify water damage and other hidden damage detection. Engaging local professional inspectors with local expertise ensures the investigative processes are exceptionally thorough, accounting for area-specific challenges and regional challenges that professional inspectors know, making the property evaluation accurate and reliable for confident investment decisions.

Effective Inspection Strategies

For investors in remote property assessments, hiring certified, local, property inspectors and requesting comprehensive written reports is essential to gain comprehensive property insights and prevent potentially catastrophic financial consequences from uninformed property acquisitions. Obtaining multiple independent assessments, reviewing historical maintenance documentation, and conducting physical site visits whenever possible ensures a rigorous property inspection. Leveraging technological advancements such as drone surveys, digital imaging, and detailed virtual inspections allows remote property assessments to approach the accuracy of immediate physical presence, offering professional assessment, risk mitigation, and strong decision support at a modest expense for any investment.

Bridging Language Gaps for Smooth Management

For overseas landlords managing rental properties, language barriers can make effective communication with tenants and local contractors challenging. Overcoming language barriers requires careful consideration of various factors such as cultural differences, local language, and the role and responsibilities of all parties. Employing interpreters, translation services, and translation tools helps bridge the gap when communicating important documents or navigating local regulations, while learn basic phrases and body language enhance day-to-day interactions.

In my experience, establishing channels through social media platforms, email communication, and text messaging allows concise communication and written record of conversations, ensuring adherence to agreements and regulations. Using easy translation software and leveraging technology to understand messages helps tenants and contractors communicate fluently. Combining a patient approach, awareness of best practices, and attention to key considerations ensures that rental properties are managing effectively, facilitating smooth operations and achieving success despite language barriers

Leave a Reply