Table of Contents

A Practical Introduction from Real Experience

Buying property abroad is an exciting adventure, but from my experience helping clients and making my own investment, the biggest hurdles are always coming up with the money and choosing the right options for financing overseas real estate. People buy for many reasons: a holiday home, an investment property while a child studies, or a place to retire. No matter the goal, the moment you move beyond your own country of residence, things change fast, and that’s where smart planning matters.

From the start, you may arrange an overseas mortgage with a local bank, apply for a mortgage from an overseas lender, release equity from a home you already own as property, or pay in cash outright. Each overseas mortgage tied to a property outside your residence needs a different approach based on your personal financial situation. I always advise clients to do deep research, weigh the pros and cons of every option, and then decide calmly, because the hidden perks of owning overseas property are real.

When acquiring overseas real estate, I’ve seen exceptional wealth building opportunities that domestic markets simply don’t offer. International mortgages open doors to tax advantages, currency appreciation, lifestyle benefits, and even citizenship pathways. Still, many investors hesitate at a critical juncture: securing optimal financing for cross border acquisitions. While cash purchases feel straightforward, they can limit purchasing power and portfolio diversification potential.

From a professional view, financing international real estate investments is a crucial aspect every investor must consider. As investment opportunities abroad keep expanding, understanding various financing options becomes essential. In this article, inspired by Orience, I often explain loan financing alternatives as an essential guide for investors who want to diversify a portfolio with overseas property. It’s a savvy financial decision, but international financing, local laws, foreign languages, and volatile exchange rates can leave anyone overwhelmed.

In practice, the biggest challenge is finding funds for this cosmopolitan investment. The good news is there are clear paths to finance a dream home if you follow an expert guide and spot the right opportunity. Since U.S. banks won’t finance foreign real estate, I often outline alternatives like seven ways to fund an overseas purchase. These include local or international bank loans from global lenders such as HSBC, usually with higher interest rates like 10%+ and strict documentation requirements.

Other real-world tools include a home equity line of credit (HELOC) using equity in a U.S. home, with rates that are variable around 8–11%, where your house is collateral. I’ve negotiated seller financing with flexible seller payment terms, down payments of 20–50%, and interest rates of 6–10%. Developer financing on new construction projects may have down payments of 10–30% and interest rates near 12%. Advanced investors use self directed IRAs, retirement funds, track income and expenses, or choose private lenders and hard money loans with fast approval in 10–14 days, high interest of 8–15%, and short repayment terms, always balancing pros cons, approval speed, risk levels, risk tolerance, and investment goals.

Today, global investors, not just citizens or residents, from Singapore, London, Hong Kong, Dubai, and Toronto, purchase markets without residency. Cross border investment financing relies on international mortgages for non resident buyers, where LTV ratios, income requirements, documentation rules, currency considerations, and how risk is evaluated all matter. Firms like GMG bring experience structuring international mortgages across 21 global markets, offering a clear guide so overseas buyers can finance property abroad without residency, using mortgage and bridging loan solutions that deliver speed and clarity.

Finally, when investing in international real estate for financial growth, portfolio diversification, or a second home, remember that funding is a complex process. The right financing options, key considerations, and practical tips help manage challenges like exchange rate fluctuations, notary fees, international payments, unfamiliar legal and financial systems, and the full process of financing property overseas.

A Smarter Way to arrange an overseas mortgage from Home

From my own work with banks and building societies like HSBC, I’ve seen how using international banking services can help you arrange mortgage options before buying property overseas. When you start in your home country, the lending bank already feels familiar, understands your credit history and credit score, and can increase chances of getting a mortgage even though it’s a different process from domestic mortgages. You often get support in your own language, avoid translation problems, and save money on translation service fees, making the mortgage process quicker. The bank can also help you choose a local lender or overseas lender in your chosen country or territory, where legal protection, foreign ownership laws, tax rules, planning permission, insurance, and other details are important to review with a local lawyer, qualified, in practice, from the current country, specialising in international real estate transactions.

In more complex cases, I’ve helped clients access international mortgages through private banking channels, which follow a different model like asset-backed loans. Here, you establish an investment portfolio relationship with a lending institution, using property as primary collateral or primary security, sometimes at 50-100% loan value on an overseas property, or secondary collateral with loan-to-value ratios of 50-80% depending on property location. Terms usually run 5-15 years with a flexible repayment option, which many investors use alongside citizenship-by-investment programs in the Caribbean. This form of international mortgage financing is a powerful opportunity when you have substantial capital, want qualifying property investments, and need structured financing to leverage existing assets while accessing prestigious citizenship programs. While local banks can be reluctant to finance citizenship-by-investment properties, this common obstacle can be overcome with a specialized private banking relationships option.

If you decide to sell later, your exit plan matters, especially when foreign bank funding or a specialist broker is involved, as they have greater knowledge of the mortgage market and better access to more mortgage deals and sometimes cheaper interest rates. It can be difficult to get a mortgage overseas as a foreigner, and if you manage to get one, interest rates may be much higher. When you take out a mortgage, payments are often in foreign currency, so you must manage foreign exchange fluctuations carefully; I’ve seen money go further when the home currency is strong relative to the local currency, but a currency fall can make payments more expensive when converting a devalued currency into an overseas currency to cover payments. Many clients use overseas lender options only when recommended, and always with their own independent lawyer and translator to protect against fraud.

Choosing a Local Mortgage Path

From my experience working with international buyers, starting with a local bank or another financial institution in the country where you are purchasing property can sometimes be the most practical way to secure mortgage options. Local lenders often offer lower interest rates, but they usually require clear proof of local income, a valid residency permit, and often a substantial down payment, which can feel demanding at first. I have seen clients succeed when they took time to understand how local systems work, built trust with the bank, and aligned their finances to local expectations, making this route more realistic and stable when conditions are met.

Working with International Mortgage Lenders

From my professional experience, global banks and large financial institutions often offer international mortgages that are specifically designed for foreign investors who want structured loans across borders. These lenders usually require a strong credit history, high net worth, and extensive documentation to prove income and long-term financial stability, but when done right, this route can feel smoother than local options. I’ve seen investors benefit from the lender’s global view, clear processes, and familiarity with cross-border risks, which helps reduce uncertainty while financing overseas property purchases.

Unlocking Home Equity for an Overseas Buy

From my own experience advising buyers, many consider refinancing their own home when they afford it and have enough equity to use home equity as a savvy investment. This means using money from your property you own to pay for a property abroad without selling your home. For example, if your home worth USD400,000 and your mortgage balance is USD100,000, the difference is USD300,000 in equity in property, and as value goes up through home improvements, favourable market conditions, or overpaying mortgage payments with extra money or additional payments, your home equity can increase. Many people pay off earlier to reduce interest payable that is charged, but always check for early repayment limits based on the type of mortgage.

When releasing equity, you free up value as cash to fund an overseas property, but you must think carefully because mortgages rely on compound interest, which can add up even if you pay as you go and later receive less when a house worth changes in the market. Some owners exchange for cash or borrow more money against home, increasing the size of mortgage, so monthly repayments increase. Always make sure you afford repayments to avoid your home repossessed, especially if house prices go down instead of go up, the value falls, and you face negative equity because you borrowed more money and your home worth less.

Rules vary by countries like Australia, where banks may not accept foreign property as security, so the home loan may limit borrowing to a certain percentage of property value, often 80%, known as Loan to Value Ratio or LVR. U.S. banks are sometimes more inclined to sign off on loans secured by domestic assets, making borrowing against home equity easier in your home country. Whether it’s a type of loan paid as a lump sum to purchase property abroad, or you owe $400,000 on a mortgage with a home worth $600,000 giving $200,000 in equity, be careful when borrowing money. If house prices go down or go up, you still must afford monthly payments to prevent your home being foreclosed. Many own property owners choose a home equity loan or line of credit to fund an international purchase, an option that helps leverage the value of an existing property, potentially benefiting from lower interest rates.

Measuring Your Usable Equity Capital

From my experience in finance, the first step is to determine your available equity, because most lenders expect at least 20% of the value of the property as equity, where only 10% of the value of property can come from personal savings held in a savings account or the 3rd pillar. A repayable loan or consumer credit is not possible for this purpose, so you cannot add borrowed funds. The remaining 10% or more can come from the 2nd pillar, also known as LPP or compulsory occupational pension provision, which is designed to finance retirement but can be used for a property purchase under specific rules.

To do this correctly, I always advise clients to contact their pension fund to find out the exact money available for promotion of home ownership, as there can be possible consequences if you use more than 10% from retirement savings. Experts are often at your disposal to help you determine the real available equity using clear examples: personal savings of CHF 60,000, 3rd pillar insurance with a surrender value of CHF 20,000, and 2nd pillar state funds of CHF 200,000, where only CHF 180,000 may be usable under encouragement for home ownership. In practice, you might use CHF 100,000 from the 2nd pillar as equity, even though the total shows CHF 180,000, which keeps your financing balanced and realistic.

Estimating What You Can Buy

From my experience, the basic rule is simple: your equity must be at least 20% of the value of the property being purchased, with only 10% coming from cash and the rest as equity capital. For example, if you have 180,000 in cash from your 2nd pillar and 3rd pillar, you can invest this amount to reach a maximum property value of 900,000, because 20% of 900,000 equals 180,000. If the amount from your 2nd pillar is higher 2nd pillar savings, such as 180,000, you may aim for a target property with a higher price, but you must evaluate the impact on your retirement fund carefully before committing.

Paying Fully in Cash

From my experience, when you have sufficient capital, buying property outright with cash can greatly simplify process and eliminate need for financing, which is helpful when dealing with overseas rules and timelines. However, this approach can limit your liquidity and reduce investment diversification, so I always advise weighing the ease of a cash deal against the flexibility you may lose by tying up a large amount of funds in a single international property.

Paying Cash for Overseas Property

From my own experience, having the right funds can make buying property abroad with cash a clear way to overcome many challenges linked to borrowing money, as long as you afford it and your savings can cover expenses like international bank transfer fees, tax fees, legal fees, translator fees, furniture, shipping, insurance costs, and other ongoing costs needed to maintain property. When paying cash, you don’t worry about paying back interest on a loan, and this gives you an edge with bargaining power, as potential buyers and owners are often keen to sell quickly, especially when deals depend on speed and certainty.

Still, I’ve learned to be careful: you need bank accounts in both countries, which may incur transfer fees, although tools like HSBC Global Transfers allow you to transfer up to USD200,000 per day, or the currency equivalent, often free across several countries and regions such as Australia, Indonesia, Mexico, US, and UK. When you decide to pay cash, remember it is still an investment that means tying up a big chunk of money in one asset, reducing liquidity, so be wary when buying off-plan, as a developer may runs out of funds, leaving a half-built property after handing over money. This is why I always insist on independent legal advice and financial advice before committing.

Understanding the Required Deposit

From my experience, non-resident buyers in the U.S. and many countries face a heftier initial payout because lenders usually expect a larger percentage of the property value as a deposit, often 30%-50%. This safeguard is meant to reduce exposure and protect against potential risks for the foreign investor. I’ve seen buyers treat it like a gamble if they don’t plan properly, so careful budgeting is essential before committing to a dream villa or apartment overseas, as the steep entry fee can be a shock if your account back home isn’t ready to put down the required sum.

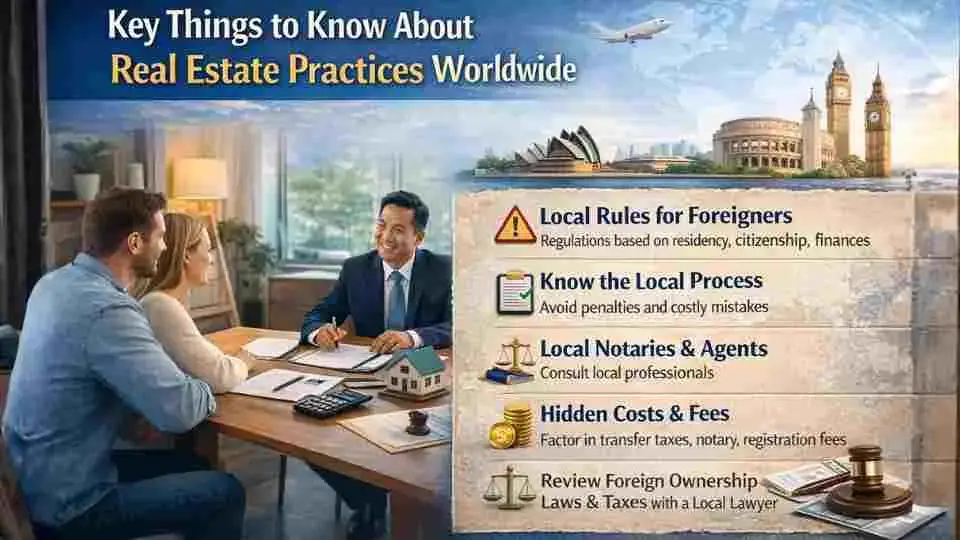

Key Things to Know About Real Estate Practices Worldwide

From my experience, real estate practices vary greatly around the world, so it’s important to understand the local process to avoid risk and costly errors, including violating laws or government-mandated restrictions. Many countries have rules on foreigners owning property, which may depend on your buyer country of residence, citizenship, or financial situation, all of which need to be taken into consideration before committing. The biggest hurdles when buying foreign real estate involve navigating the country’s real estate landscape, as each country has its own set of hoops to jump through, depending on the buying deal and local customs. You may need notaries, attorneys, or real estate agents, while back home, a variety of fees like transfer taxes, notary costs, and registration fees must also be taken into account and can add up significantly in the total expense.

Checking Your Eligibility as a Foreign Buyer

In many countries, there are strict requirements for foreign buyers, with restrictions linked to residency status and nationality. While permanent residents and citizens are often allowed to own real estate more easily, others must obtain special permission from the government and meet specific financial criteria to be considered eligible. In my experience, it is usually required to show proof of income, declare assets, and sometimes complete a criminal background check, which can make the process feel slow but is standard practice in many market.

| Australia | Non-residents usually need foreign investment approval. New dwellings or vacant lots must be developed within 4 years. Early understanding avoids delays. |

| China | Foreigners can buy commercial property but often must occupy it themselves. Careful planning is needed for financing. |

| Portugal & Spain | Foreign investors should live in the home at least 5 years; may lead to property-based citizenship. Financing ties to lifestyle and legal planning. |

| Singapore | Permanent residents living ≥5 years usually don’t need approval to buy apartments or condos. Residency requirements simplify loans. |

| US | Non-residents can own property without business ties; income usually taxed around 30%. Early understanding helps plan cash flow and financing. |

Weighing Costs and Risks Before You Buy

From my experience, it’s vital to consider all costs and risks when buying overseas, including tax and insurance, which can differ widely between the US, UK, and other countries. In some places, you may receive a title to a property where ownership is not clear, so it’s always recommended to work with a qualified real estate professional and seek independent legal advice and financial advice at every stage of the buying process.

Measuring Your Financial Burden

From my experience with Mortgage interest, the starting point is your equity and amortization capacity, which a bank uses to define the term of loan and the type of rate, sometimes with a mortgage loan split offered by a financial institution. Lenders calculate your borrowing capacity using a theoretical rate of 5% to test a possible increase in rates, even when rates are very low or negotiated near 1% for 10 years. It helps to contact experts like Cardis Sotheby’s International Realty to review the current state of the market and structure the mortgage loan safely with proper security.

Understanding Amortization

When taking a loan, banks generally require amortization to gradually reduce mortgage debt and interest payments. Typically, they expect about one-third of the value of the asset to be amortized over 15 years, which helps increase your equity and lowers risk. For example, on a CHF 900,000 loan, 34% or CHF 306,000 might be the amount to be amortized, with CHF 180,000 already invested as equity, leaving CHF 126,000 to amortize. The annual amortization would be CHF 8,400, roughly CHF 700 per month, and banks use these calculations to estimate your ability to amortize based on income and other factors.

Leave a Reply